Tectonic Shifts in the Retail Environment

The symbiotic relationship between retailer and Consumer Packaged Goods (CPG) companies has, till now, been able to support steady growth based on demand alone. Now, as the Consumer Goods (CG) industry continues to shift away from organic expansion, the need to reach more customers and engage new audiences is more important than ever.

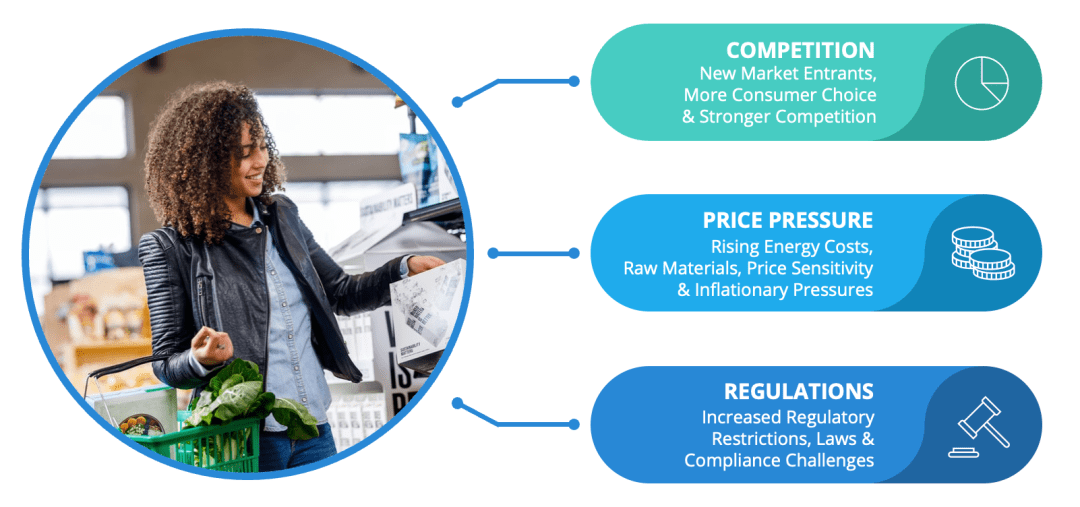

Let’s dive in to some of the key shifts our customers are seeing in the retail environment:

- Competition: Authentic challenger brands are continually entering the market. According to a recent survey carried out by McKinsey, 30-40% of consumers have been trying new brands and products during the pandemic. Of these consumers, 12% expect to continue to purchase the new brands after the pandemic. More competition = more difficulty obtaining or retaining market share.

- Price Pressures: Global supply chain stress has created a multitude of issues for companies seeking to keep costs down. Disruptions in labour markets have seen 15% of companies with insufficient labour for their facilities to keep up with increases in demand, leading to inflation re-emerging as a significant problem for the first time since the 1970s.

- Regulations: Changing consumer needs are not only encouraging the rise of new, healthier alternative brands but also instigating real legislative change. For example, in October 2022, HFSS (High in Fat, Salt & Sugar) regulations will see a crackdown on promotions for unhealthy food and drinks, which will have serious repercussions for both suppliers and retailers.

Traditional Account Management Is Obsolete

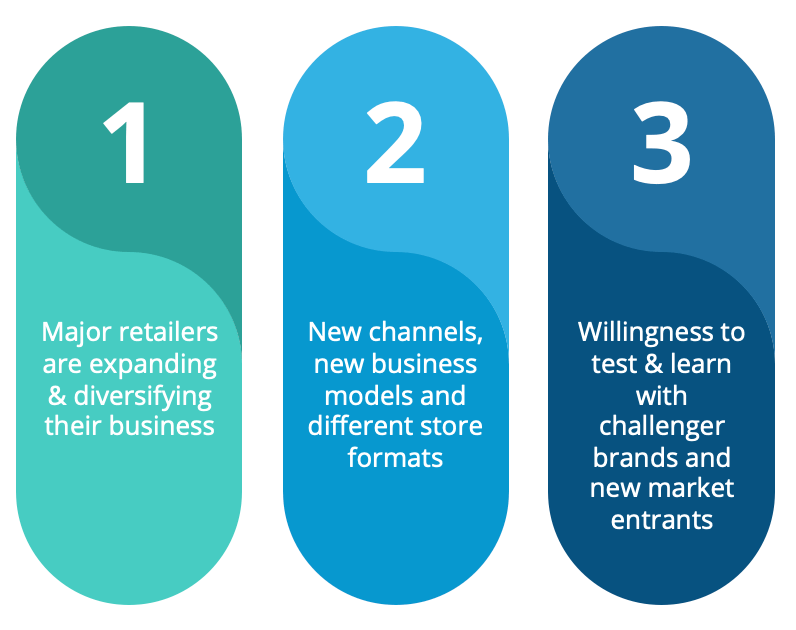

These shifts have caused retailers to change the way they do business; the traditional playbook needs to be thrown out and rewritten. The diversification we have seen in channels, models and store formats means that retailers’ expectations for suppliers have changed. And, as increasing numbers of authentic challenger brands come to market, competition has never been higher.

For both retailers and suppliers, Key Account Management (KAM) needs to be revisited. A culture of test & learn in real time needs to be applied to contend with these new market entrants and, with “key accounts contribut[ing] between 40% to 80% of revenue for a branded supplier” in developed markets as indicated by this article by Bain & Company, the time to reinvent is now.

Major incentives for change can be distilled into these three points:

Negotiation Can Feel Like a Zero-Sum Game

In the past, the CPG industry power dynamic has often favoured the supplier, but this is no longer the case. Only 3% of retailers are in an exclusive relationship with just one supplier in a given category, indicating the clout they hold to sway access to consumers is higher than ever before. With a number of Consumer Goods companies falling prey to a one-size-fits-all to their global business models, they have been losing valuable ground to more specialised, relevant competitors.

For CPG companies, visibility at point-of-sale for their products is vital. For retailers, getting the product in-store to sell is their business. Having retailers being ‘on-side’ and aligned is game-changing for suppliers.

But, as indicated in the name, Joint Business Plans need to be exactly that: Joint. If the manufacturers arrive at the table with a railroad agenda, offering little to no agency to the retailer, it will be too one-sided and off balanced. If retailers have unrealistic expectations, e.g broad assortments or 24-hour delivery, from certain suppliers, the equilibrium of the plan will be thrown off from the outset. This is where the value of insight-sharing cannot be understated; IGD asserts that both sides must ‘be prepared to share information with each other’ to achieve success.

Both CPG companies and retailers need to be able to influence the plan and offer respective insights to avoid creating a zero-sum atmosphere.

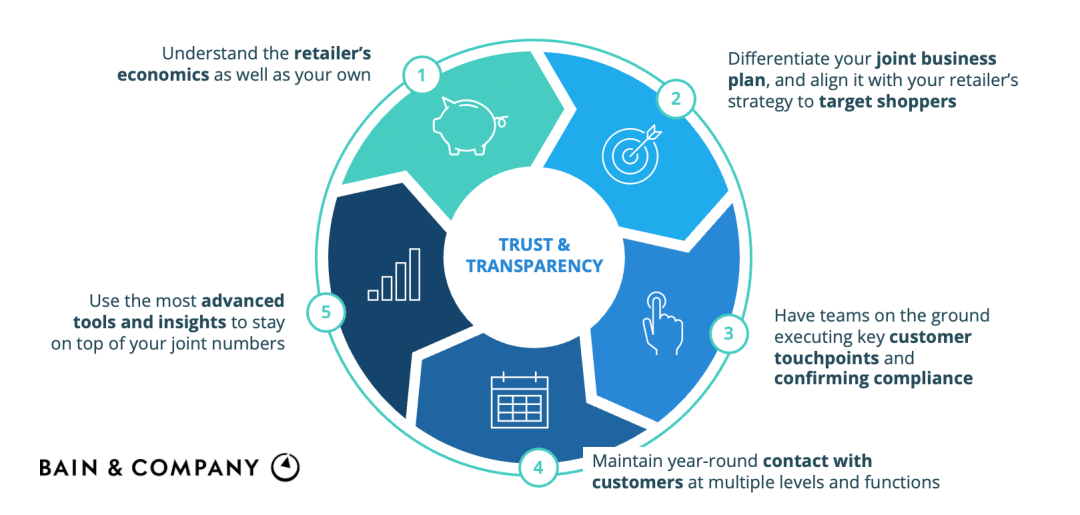

How Can Joint Business Planning Be Achieved?

For companies collaborating on Joint Business Plans, certain proactive steps need to be taken to fit the plan to benefit both parties. Bain & Company have set out five key steps that they have seen Consumer Goods companies take to achieve ‘more trustful and productive’ relationships and provide significant value.

1. Understand the Retailer’s Economics as Well as Your Own

Entering into a business relationship, such as a JBP, with a full understanding of where a potential partner is in the market is pivotal to a successful collaboration. Being aware of any weaknesses provides the opportunity to address them before they become an issue and impact your business.

In turn, a complete understanding of your own business’ strengths and weaknesses before embarking on any external partnership is equally important. A Joint Business Plan can only be successful if it truly brings benefit to both the retailers and CPG companies; without this, joint commitment can’t be assured.

This demands the creation of an environment where retailers and CPG companies can offer total visibility into their data, thereby enabling creation of target audiences and consumer journeys. As indicated by an IGD Industry Survey, ‘Too often trust is the biggest barrier to putting any proposal into action’. Data transparency reduces the possibility of down-the-line surprises and potential derailing of the plan.

2. Differentiate Your Joint Business Plan and Align It With Your Retailer’s Strategy to Target Shoppers

While keeping costs down may be advantageous, it is vital not to lose sight of the top priority; understanding the target customer segments.

Customer data extracted through the collaborative JBP can help maintain product stock levels, illustrate demand and identify trends in product distribution. Without this information, even a theoretically perfect Joint Business Plan will fail. Understanding who the customers are and what they are buying better enables CPG companies and retailers to produce and distribute – keeping the customer’s needs at the crux of their strategy.

It’s important to note that Joint Business plans are not one-size-fits-all; it may take more time to differentiate a plan to make it more tailored to a specific relationship, but the benefits can outweigh the expense.

3. Have Teams on the Ground Executing Key Customer Touchpoints and Confirming Compliance

Research by POI illustrates that 58% of CPG companies are struggling with retailer aligned compliance for store-level promotion execution. Clearly, there is a concerted need to ensure in-real time that assured promotions are being carried out, but 27% of CPG companies do not get any real-time insights into retailer compliance, forcing them to wait until the end of a cycle to make any significant changes.

While promotion compliance isn’t a new issue in the Consumer Goods industry, it can be a major roadblock to a JBP. With teams in the field, far more regular compliance checks can be performed and the information shared much wider, much faster.

4. Maintain Year-Round Contact With Customers at Multiple Levels and Functions

The dialogue between each party needs to continue beyond initial negotiations and agreements. Regular meetings provide opportunities to correct mid-cycle issues, where the retailer and CPG company can align on real-time results and solutions.

Without clearly defined and tracked performance metrics, the success of the JBP is uncertain. Both parties need to agree on what data sources are going to be reviewed. Expectations must be laid out internally and externally, to establish what each side hopes to get out of the arrangement. This will prevent potential disappointment if or when unaired expectations aren’t met.

It is also important to have discussed and agreed upon the terms and investment in the JBP. Going into a project aware of the value that each business is adding to the other and being able to quantify the ROI is fundamental to a successful Joint Business Plan.

5. Use the Most Advanced Tools and Insights to Stay on Top of Your Joint Numbers

As shown in the recent Promotion Optimization Institute (POI) State of the Industry Report, 64% of manufacturers have challenges when looking for data from retailers. When data is such a foundational element to gainful retailer partnerships, it needs to be shared. The ideal is to involve teams from across the company including distribution, sales, finance and marketing. Siloed internal communication can negatively impact information sharing and lead to failure of a JBP.

CPG companies need to leverage real-time insights pulled from a range of commercial data sources that allow them to optimize strategies based on their business goals and current supply and promotion constraints. This maximises the value of every dollar invested in trade spend.

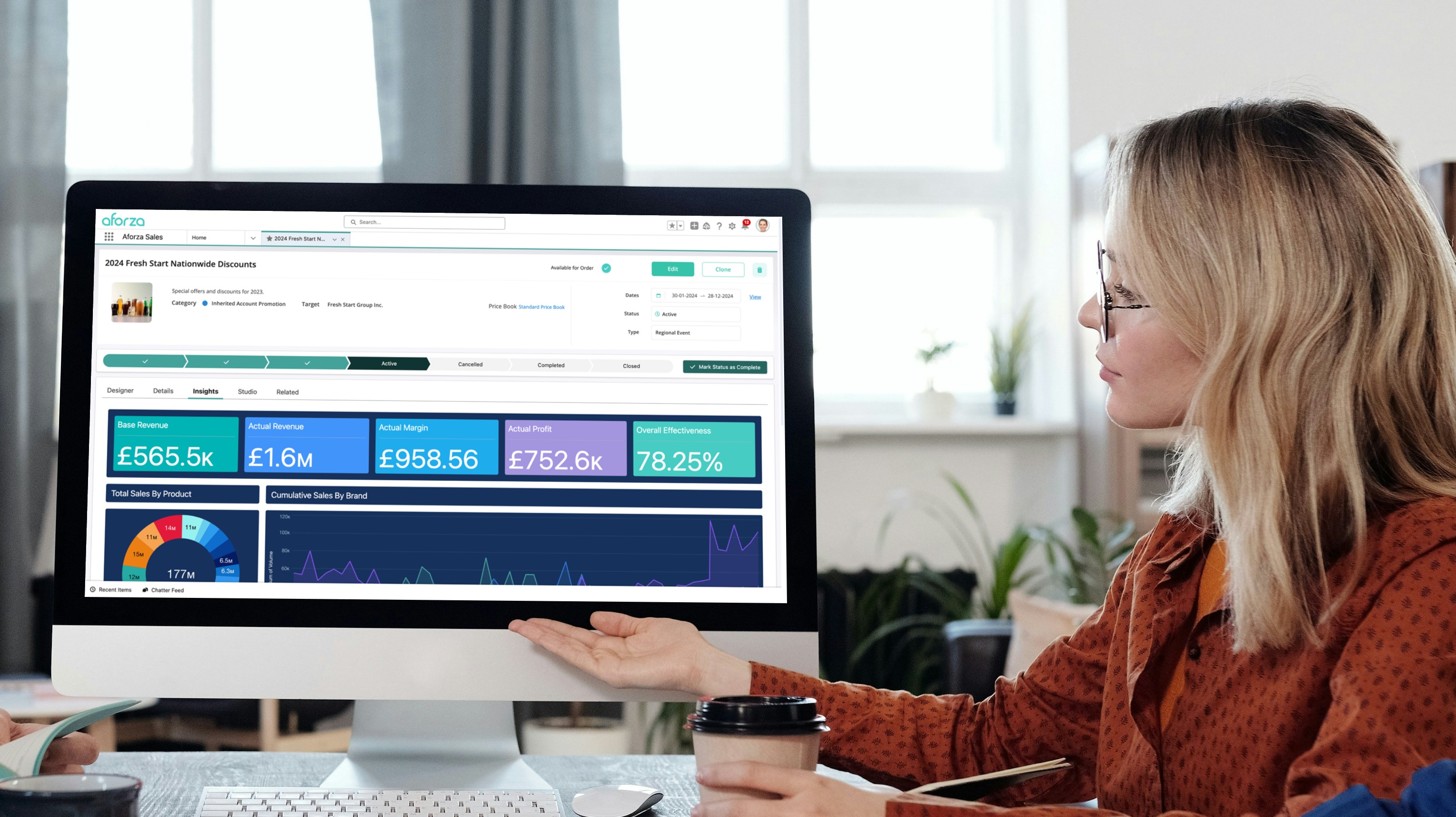

Aforza & Joint Business Planning

Closely aligned with the tenets of Bain’s Key Account Management Commercial Excellence framework, Aforza drives Joint Business Planning with an end-to-end platform of core functionalities:

- Account 360° View: Gain a complete view of an account’s hierarchies and key relationships, as well as visibility into all engagement activity across channels.

- Real-time Data & Insights on Account Performance: Get real-time insights, from a range of commercial data sources, across all aspects of your key account performance.

- Integrated Trade Promotions: Optimize trade spend and target key customers by displaying a real-time view into promotion performance, inventory levels, sales order insights, budgets & funds, plans & objectives.

- Retail Execution Checks from Field Sales Teams: Leverage your teams in the field to check key account compliance and take promotion-based order capture with penny-perfect pricing on mobile; online or offline.

- Digital Asset Management: Ensuring all important business documents are centralised and accessible against the account, such as contracts and Joint Business Plans.

Check out this demo from Aforza’s Chief Product Officer, Nick Eales, as he showcases how leading Consumer Goods companies are leveraging Aforza to create productive account collaborations that unlock revenue potential like never before:

With industry-leading innovations and capabilities, the Aforza cloud & mobile solution continues to help consumer goods companies sell more and grow faster. Take the first steps now and create productive account collaborations that unlock revenue potential like never before.